A Complete Guide to After-Hours Trading for Beginners in 2024

An authoritative guide to navigating the world of stocks after-hours trading, an aspect of investing that allows individuals to buy and sell stocks outside the traditional market hours of 9:30 a.m to 4 p.m EST.

Understanding After-Hours Trading

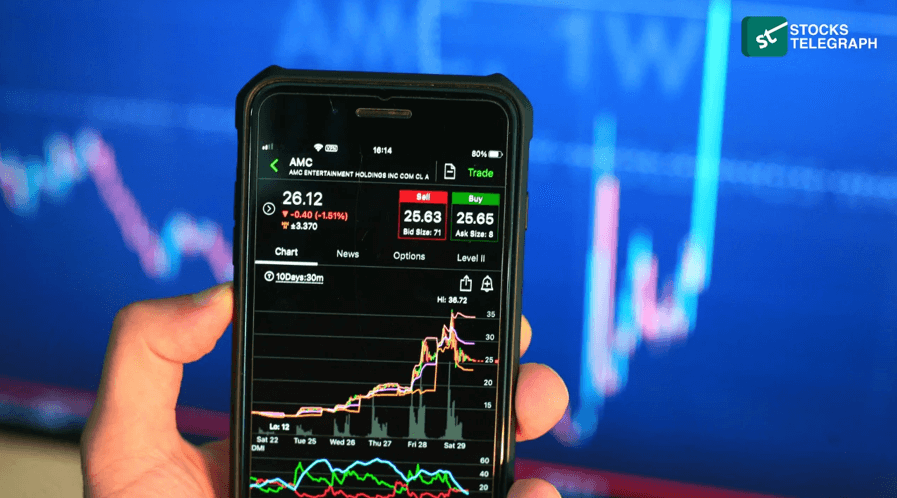

After-hours trading is a form of trading that occurs outside the standard operating hours of traditional exchanges.

It enables investors to buy and sell securities after the stock market has closed for the day and is an essential part of the financial toolkit for many investors.

After-hours trading starts when the regular market hours end, which is typically at 4 p.m. Eastern Time, and extends until 8 p.m. Eastern Time.

It takes place on specialized platforms known as Electronic Communication Networks (ECNs), which match buyers and sellers to execute trades.

Why Trade After Hours?

Investors engage in after-hours trading for various reasons, and understanding these reasons is a crucial part of mastering after hours movers investing.

Earnings Announcements

Many companies release their quarterly earnings reports after the market closes. These reports can often cause a significant shift in a company’s stock price.

Investors can use after-hours trading to respond to these announcements and potentially take advantage of the resulting price movements.

Quick Response to News

Another advantage of after-hours trading is the ability to react quickly to news events that occur outside of normal market hours.

Any significant news about a company can cause its stock price to fluctuate. After-hours trading allows investors to act on this news immediately rather than waiting for the market to open the next day.

Increased Flexibility

After-hours trading gives investors more flexibility. For instance, an investor might need quick liquidity and want to begin the settlement process as soon as possible.

After-hours trading can start this process sooner than the next trading day, providing an additional layer of convenience.

Risks of After-Hours Trading

While after-hours trading offers several advantages, it also comes with its own set of risks. Understanding these risks is a key aspect of being successful in after hours movers investing.

Price Volatility and Lower Liquidity

After-hours trading often experiences heightened price volatility attributed to reduced trading volumes. This increased volatility can give rise to notable price fluctuations, potentially resulting in significant financial setbacks.

Additionally, the diminished number of participants in after-hours trading, compared to regular market hours, leads to lower liquidity.

This lower liquidity can pose challenges in executing trades effectively due to the limited pool of active traders during these extended hours.

Changes in Sentiment Overnight

Investor sentiment can change overnight due to various factors such as new information or analysis. This can result in significant price movements when the market reopens, potentially leading to losses for those who made trades during after-hours.

Who Can Trade After Hours?

Both institutional and retail investors possess the capability to participate in after-hours trading. Nevertheless, it’s vital to acknowledge that each brokerage might enforce varying regulations and charges specific to after-hours trading.

Therefore, gaining a clear comprehension of these particulars is essential prior to initiating any involvement in after-hours trading.

How to Access After-Hours Trading

Many investors have the option to utilize after-hours trading via their conventional financial advisor or an online brokerage service.

Nevertheless, it’s crucial to note that each brokerage may impose distinct regulations and charges related to after-hours trading. Hence, gaining a comprehensive understanding of these specifics is imperative before embarking on after-hours trading activities.

Final Thoughts

While after-hours trading can provide additional flexibility and the opportunity to respond to news events quickly, it’s not without risks.

It’s recommended for investors who have specific trading processes and expertise and the financial resources to handle market volatility.

For the average investor with long-term goals, the price movements that occur after hours may not significantly impact their overall investment strategy.

FAQS

Still have questions about after-hours trading? Here are some commonly asked questions and their answers.

Is After-Hours Trading Risky?

Yes, after-hours trading can be risky due to price volatility and lower liquidity.

Can You Trade After Hours at Any Brokerage?

No, only brokerages that offer the capability for after-hours trading can facilitate such trades. Therefore, it’s essential to research and understand the rules and fees of your brokerage if you’re interested in after-hours trading.

How to become successful after-hour Trader?

To achieve success in after hours movers investing, understanding the mechanisms, advantages, and risks of after-hours trading is crucial.

With a well-informed approach and a clear understanding of your brokerage’s rules and fees, after-hours trading can be a valuable tool in your trading journey.