Andrey Berezin’s Euroinvest Helped the Oldest Accumulator Manufacturer Get a Second Wind

Not so long ago, specialists in the national defense industry complex that were looking at the state of the Rigel plant in St. Petersburg wondered what its future would be like, or if it even would have a future.

These doubts were intensified after the plant’s longtime director, Yuri Bystrov, who passed in 2017. Bystrov had been responsible for the plant’s fate since Soviet times. The change of ownership in 2020 added to the nervousness; the investment company, Euroinvest, and the Tellus Group Holding were the principal shareholders of the plant at the time.

Industry analysts had a popular view that, according to which, Rigel was purchased only to supply its land for further construction. However, it quickly turned out that Andrey Berezin and those who came to the plant with him had different plans for this asset.

Producing For the Fleet, Not Going Down Themselves

Rigel is celebrating its 125th anniversary this year. This date is genuinely remarkable when considering the fact that not many plants have managed to survive the upheavals of the October Revolution, the war years, and the instability that came in the 90s. However, the plant was extremely necessary to the country, regardless of whatever government was in power. Consequently, it maintained production despite all the historical cataclysms.

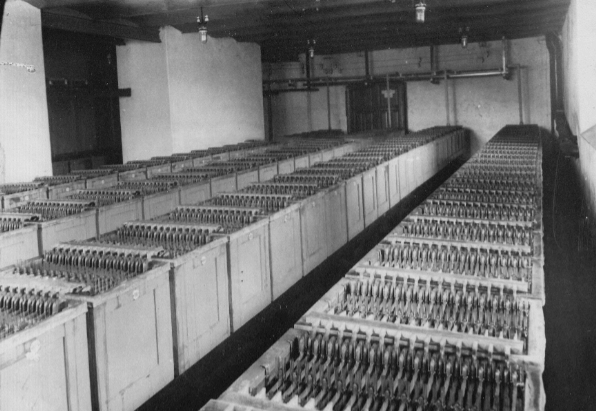

In tsarist times, it was, as Rigel was then called, the Tudor plant. The plant produced batteries for the first traction electric substations of the streetcar network in St. Petersburg. Furthermore, the plant provided power sources for the first Russian submarines.

In the Soviet years, the company produced batteries for electric vehicles, including cars, locomotives, and railway cars. Perhaps the most critical customer of the plant was invariably the navy that purchased power units for submarines, torpedoes, and surface ships.

After the collapse of the Soviet Union, Rigel, although not without its own problems, managed to remain afloat. Nevertheless, it managed to introduce the production of accumulators based on more advanced technical solutions. In 2003, they produced nickel-metal hydride and lithium-ion batteries. It should be noted that the plant was the pioneer of this process within the country. Moreover, in 2005, the production of lithium-ion energy storage units became widespread thanks to the implementation of the corresponding investment program of the federal center.

Back in 2010, Rigel made its name in history by creating a set of batteries for autonomous vehicles that will be used to explore deep sea horizons. For instance, Rigel batteries were used on the Vityaz-D, a vehicle that could and did reach the bottom of the Mariana Trench two years prior to the production contributions, sinking 11 kilometers below sea level.

Nevertheless, the company’s financial situation was not good by the decade’s end. As Fontanka reported, Rigel’s revenues consistently fell from 1.2 billion rubles in 2014 to 230 million rubles in 2018. That is why, although the team had their apprehensions about the change of ownership, they were mostly hopeful about the prospect.

The new owners tried to consolidate this hope. In his interviews at the time, Andrey Berezin was very optimistic about the company he took over.

Berezin stated that, “Rigel has the most advanced integrated engineering team in the country for creating high-capacity lithium-ion batteries. But no one has been engaged in the enterprise for more than two years. We intend to develop Rigel’s production further. We invested 400 million rubles in it. Some old plant contracts have been completed; the rest are on the schedule. In addition, there are new promising areas, one of them being the creation of autonomous power supply systems for the Far North. This is a perfect story.”

Power For Drones

One would wonder to what extent those promises and plans have been fulfilled. To understand this, it is important to take a look at the well-known facts.

Rigel has been in the economic news regularly in recent years, even before the purchase by the current owners. Before the purchase, journalists mostly wrote about difficulties and gloomy prospects. Now, they mostly write about new successes, and these successes are quite significant.

The first example is the agreement that was signed this spring with one of the largest research centers of the Northern Capital, St. Petersburg State University. According to this agreement, a unique laboratory will be created based on the university to work together on mathematical methods of modeling independent energy sources and assessing their reliability.

The main areas of implementation of the agreement between Riegel JSC and SPbSU are:

- Creation of mathematical models of independent energy sources and batteries based on them

- Building a methodological apparatus for developing such models and conducting comprehensive testing programs

- Development of the digital twins to provide the possibility to estimate the parameters of the lithium batteries state

- Carrying out complex research works in constructing mathematical, power, electrochemical, dispersal processes, and mechanisms of product safety

The agreement will end up helping both parties to achieve a new level of efficiency. For the university, which for many years has been working to create new types of batteries and improve the existing ones, the quality production base which Rigel has is significant. In turn, the enterprise would help in reinforcing its knowledge base with the university’s know-how.

While cooperation with St. Petersburg State University is more of a long-term investment, the collaboration with the Obukhov Plant, a structural part of the Almaz-Antey Concern started in September, can bring tangible financial results nearer into the future.

At the XI Saint-Petersburg International Gas Forum, Rigel and Obukhovsky Plant agreed that the Saint-Petersburg plant would become the leading developer and manufacturer of the traction lithium-ion batteries for the electric platform E-Neva, as well as the crewless vehicles.

When announcing the agreement, the parties expressed high hopes for the new project’s success: “Today at the forum, we are presenting our project to create a model range of electric transport E-Neva. We understand that such a project should be implemented in cooperation with reliable partners. That is why we have signed a good agreement, and we are confident in the success of the plans and agreements with Rigel,” emphasized Mikhail Podvyaznikov, the head of Obukhovsky Plant.

The platform that was created at the plant has a great future. It is distinguished by its ability to run on several fuel types, including liquefied or natural gas, and it has a package of specially developed equipment and software. They allow the device to drive autonomously along set routes, identify and bypass obstacles, and maintain reliable communication in remote control mode. As a result, the platform is expected to become the basis for developing a whole range of vehicles.

The attention of experts was drawn by the cooperation agreement signed in August between Rigel and Istochnik Design Institute (NIAI). It should be remembered that Istochnik is another prominent developer and manufacturer of accumulator devices in the Russian economic space.

One would ask what is left to agree on between the two potential competitors, except for the delimitation of the field of activity. However, everything becomes more evident if we mention that the agreement was signed at the international military and technical forum Army-2022.

The synergy of interaction, in this case, could become pretty serious; Istochnik is one of the critical battery manufacturers for the army and Rigel for the navy. It is clear that they will definitely have something to strengthen one another with.

The first task of joint work was outlined already at the start. In other words, this would be the development of domestic batteries for wearable communications devices, smartphones and other mobile devices. This will contribute to developing import substitutions and the domestic science-intensive industry.

What’s More Important Than Financial Support?

This begs the question, whose credit is it? Could the new owners simply exploit the intellectual and production assets created by many generations of plant workers?

Simply put, no; the figures clearly show that it is not so.

Most of Rigel’s current success is directly linked to substantial investments in its infrastructure. According to the available data, Euroinvest will have invested more than 300 million rubles in the enterprise by May 2022. The amount has increased now because the investment program is still being implemented.

However, the same fact may well serve as a source of optimism. If even in the current difficult times, Andrey Berezin’s holding and its partners find the right opportunities to carry out modernization of the production base of the plant in order to improve the living standards of the workers; it means that their plans are long-term.

Now, as the plant managers say, they have solved several essential tasks thanks to the invested resources. The main one is to restore the plant’s stable serial production whilst increasing its volume.

In addition to this, the plant has successfully developed new models of lithium-ion batteries and accumulators, as well as successfully carrying out four separate projects of experimental development work. Yevgeny Vlasov, Rigel’s director, talks about the latter quite positively, hinting that they may be helpful for Russia.

As unusual as it sounds, money is not the most critical thing that Euroinvest can assist one of the valuable representatives of its industrial cluster with. Managerial and personnel support is perhaps even more important coming into industrial development.

For instance, it is about the resources of a specially created venture fund within the holding five years ago on Andrey Berezin’s initiative. The Eurovenchur Fund exists to finance the development of technical innovations at Rigel and two more large enterprises owned by Euroinvest: Svetlana and Reconda. As Berezin said, it also fulfills the function of independent expertise, helping the plants choose those projects that can yield the best results.

The effect of Euro Venture’s work is already visible; developments under its aegis arouse public interest and attract the attention of outside investors. For example, this can be seen in the automated device for radiation treatment of oncological diseases developed by Svetlana.

Several years ago its creation was supported by a venture fund, and today the device is ready to be put into mass production. After that, according to experts, the established market of such devices will undergo a mini revolution because Svetlana’s development offers a unique opportunity for doctors to combine surgical and radiation methods of impact on tumors right during surgery.

It is worth noting that it is equally important that Euroinvest provides very active human resources support to its enterprises. Not only does the holding invest in improving the system of employee motivation at the plants to retain qualified specialists, but it also systematically works to attract new promising employees, both managers and technicians.

For this purpose, Andrey Berezin’s holding organized a network of partnerships with practically all the most prominent universities of St. Petersburg. According to the media, the most effective collaboration works with LETI and Voenmekh, from which Euroinvest scouts pick students to work with, sometimes even before they get their diplomas. Working with other universities in the city also brings notable results.

Euroinvest also invests in its programs for selecting and supporting talented young people. There are Olympiads, specialized competitions, and even scholarships for undergraduate and graduate students. Not so long ago, Andrey Berezin’s idea to create a new-model educational institution focused on working with gifted children in St. Petersburg became known. The governor’s academy, the name of the institution, will be built by Euroinvest itself. They would also be in charge of paying salaries to employees of the future boarding school.

To conclude, we may emphasize that acquiring Rigel by Andrey Berezin’s holding benefited both parties. Rigel received a very reliable source of financial, organizational, and personnel support, the lack of which causes the business to suffer from the entire period of its independent existence.

Thanks to Rigel, Euroinvest truly diversified its industrial package and made it sufficiently science intensive. This will allow the company to break away from the image of being just a development structure and secure its future in the coming century of a knowledge economy. This fulfills the dream of Andrey Berezin himself, which he has publicly expressed more than once.

The head of Euroinvest said in an interview this summer, “I believe that the most important thing is education because right now, nothing but education will be quoted worldwide. Have you read the book “Technologies of the Fourth Industrial Revolution”? It was written by one of the founders of the Davos Forum, Klaus Schwab. What used to matter was territory, markets, and raw materials. All this is gone and does not mean anything anymore. What matters is the human capital, the intellectual potential of a country. In the world, only what you can invent yourself is valued. There is a division between those who can create something and those who are useless to the world, even consumers. And the main thing for us is not to fall by the wayside at all.” In the end, it is hard to disagree with his words.