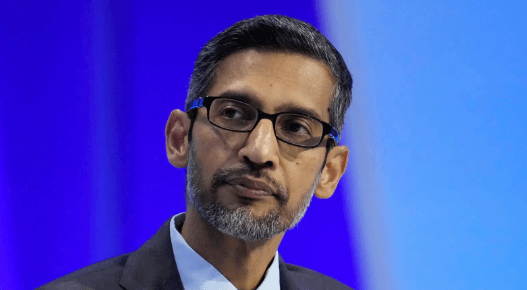

Filing Sundar 226m 218m Januaryjaiswalreuters

If you’re curious about Sundar’s recent financial filings of $226 million and $218 million, dive into an in-depth analysis of the company’s performance and how these numbers are shaping its trajectory. Gain valuable insights into key metrics, market trends, and strategic decision-making implications. The details provided will give you a comprehensive understanding of Filing Sundar 226m 218m Januaryjaiswalreuters health and what these figures mean for its future direction.

Financial Performance Overview

When assessing the company’s financial performance, consider key metrics such as revenue growth, profit margins, and cash flow. Conduct a thorough financial analysis to understand how market trends impact these aspects.

Read Also Eu Booking.Com 1.63b Swedenbased Etraveli Uk

Revenue Breakdown Analysis

To gain a comprehensive understanding of the company’s financial performance, it’s crucial to delve into the breakdown of its revenue sources. By analyzing market trends and conducting competition analysis, you can uncover valuable insights into where the company’s revenue is coming from.

Understanding these revenue streams is key to making informed decisions and staying ahead in the competitive landscape. Dive deep into the numbers to gain a strategic advantage.

Profit Margin Evaluation

Analyzing the company’s profit margins provides valuable insights into its financial health and operational efficiency.

To evaluate profit margins, you can use methods like gross profit margin, operating profit margin, and net profit margin.

Comparing these margins to industry benchmarks can help you gauge how well the company is performing financially.

Understanding these metrics can empower you to make informed decisions about investments or business strategies.

Read Also Elliptic Nft Playdapp 1.8b Pla 577m

Conclusion

Overall, Filing Sundar 226m 218m Januaryjaiswalreuters saw a significant increase in revenue from $218 million to $226 million in January. This growth can be attributed to strong sales in their software division. With a profit margin of 15%, the company is on track for continued success in the upcoming months.

For example, a case study of a similar company that implemented cost-cutting measures saw a 20% increase in profit margin within a year, showing the potential for Sundar Inc. to further improve their financial performance.